Max Weinbach on X: "So there's no set depreciation rate of MacBook Airs. This website estimates 17.1% over the first year, 36.1% over three. That means a $1900 MacBook Air is worth

Double Declining Balance (Method of Depreciation) | Double Declining Balance | By IGCSE Accounting Private | Hey there Welcome back to accounting stuff I'm James and in this video, I'll show you

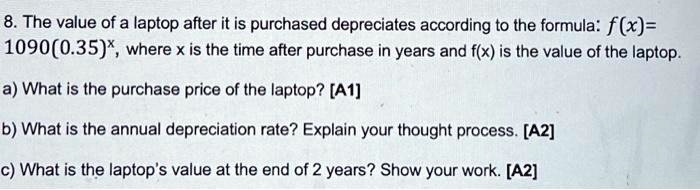

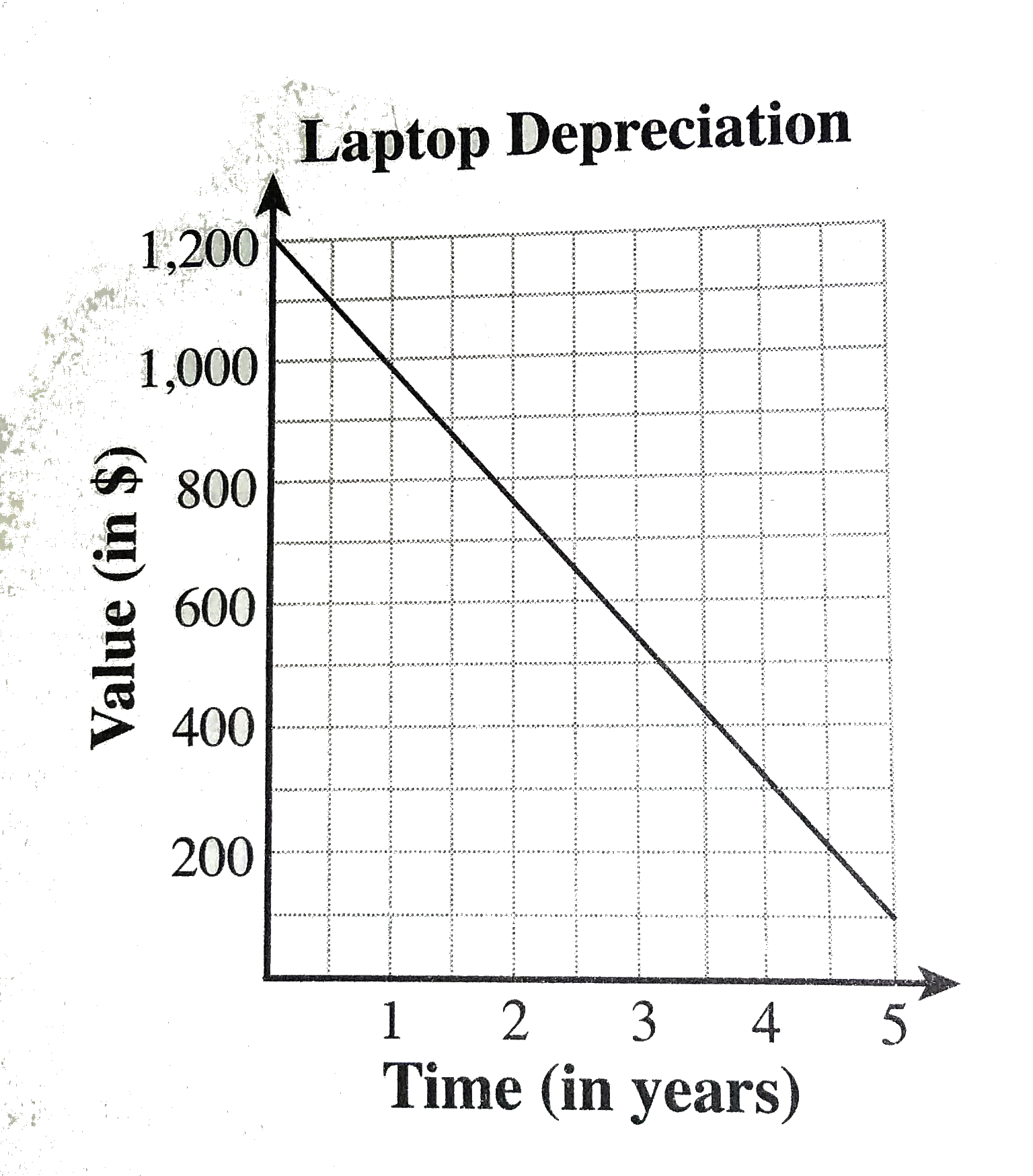

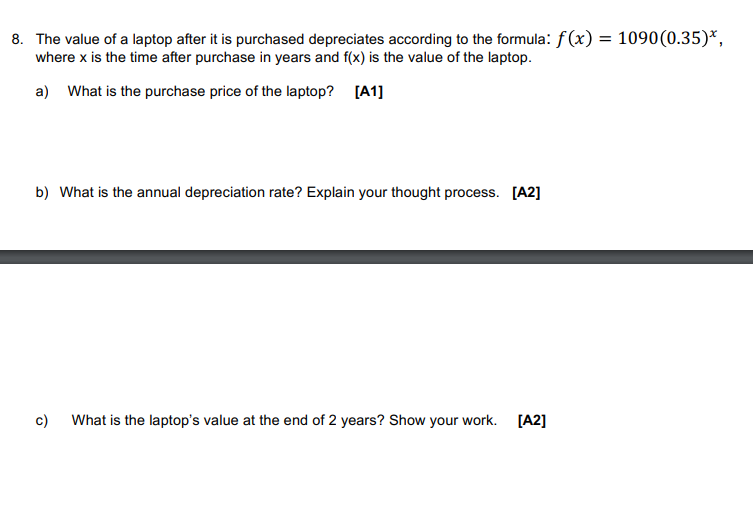

The graph represents the relation between the laptop values and the time. The average rate of change (in dollars per year) of the value of laptop over the five-year period is

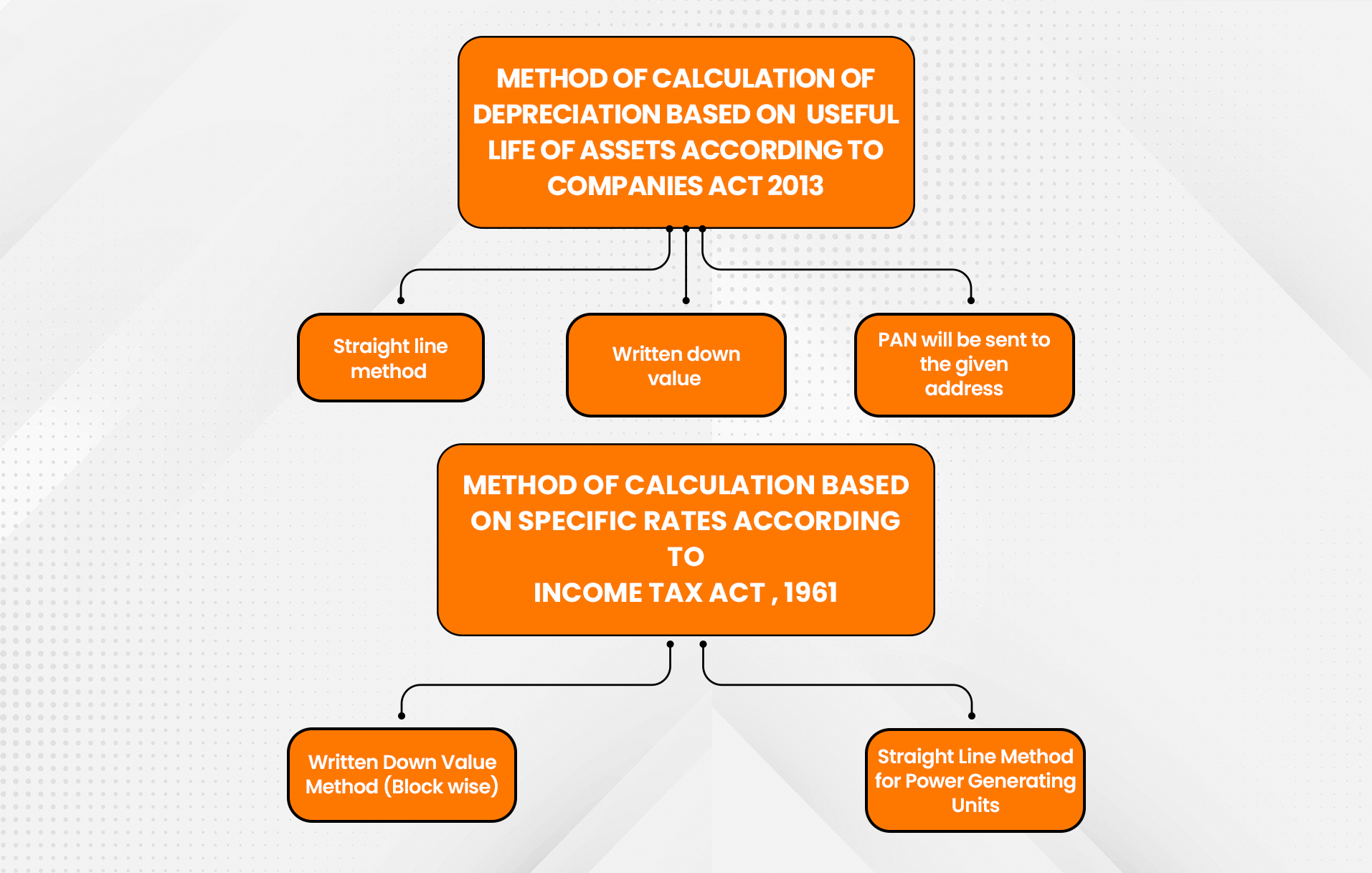

Depreciation Rate As per Income Tax Rules | Depreciation Rate Chart | Dep Rate Chart | Depreciation - YouTube

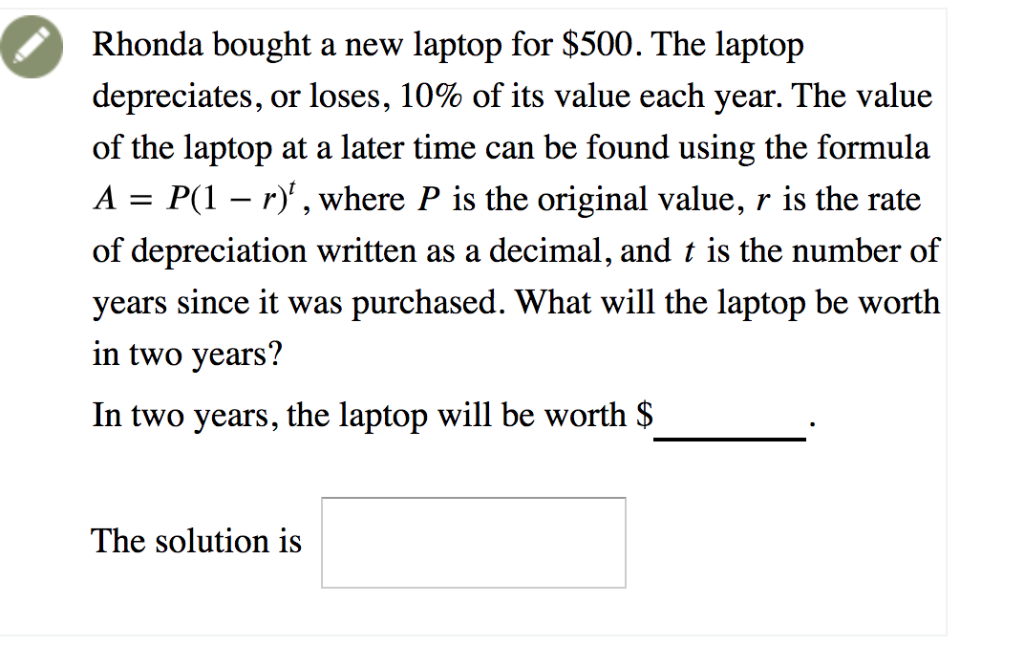

The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -